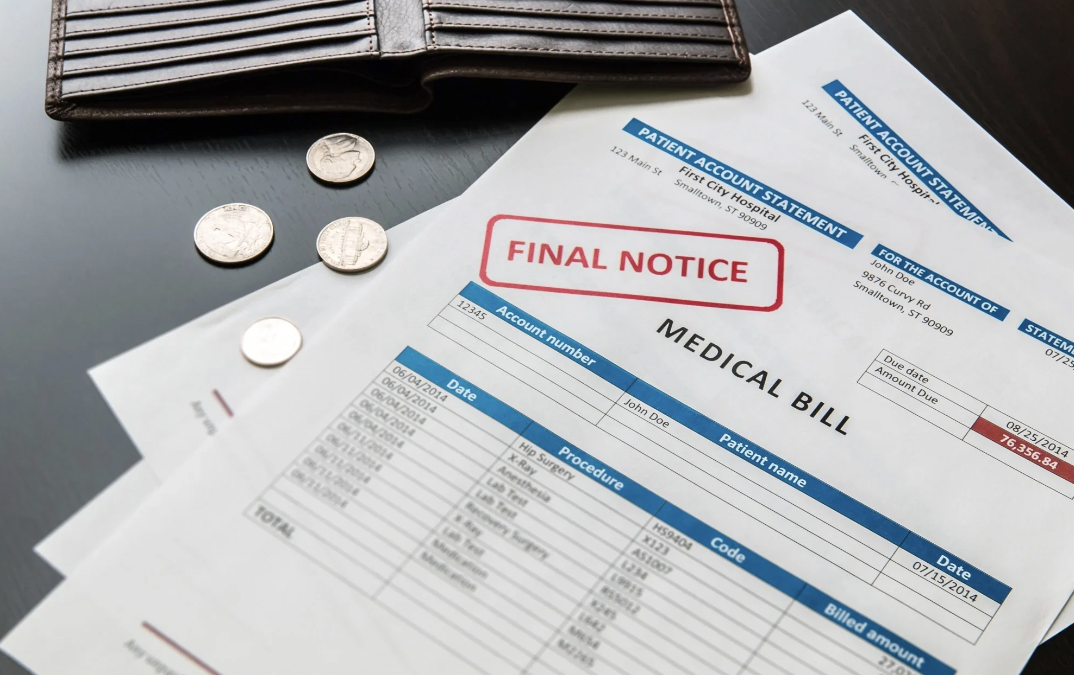

Does your phone ring, but when you answer it, you hear nothing? Have you not gotten a text from a friend or family member in a while?

Maybe you have found them online, safe and sound but a long way away from you. Maybe your electricity has gone out, and you’re finding your funds aren’t as liquid as they once were.

These are all signs that you need financial help paying bills. What do you do when, like many Americans, you find yourself in need of money fast?

Read on for how short-term loans can provide you with the financial help you need.

Understanding Short-Term Loans Online

Short-term loans online, also known as payday loans, are a popular option for individuals who need financial help. These loans provide quick access to cash, usually within 24 to 48 hours.

This allows borrowers to pay their bills. And also meet their financial obligations without delay.

Another advantage of short-term loans online is that they are available to individuals with bad credit or a low credit score. Many people face financial difficulties due to unexpected events or emergencies. This leads to a decline in their credit rating. However, online lenders specializing in bad credit loans understand these individuals’ challenges.

The Benefits of Short-Term Loans Online

Short-term online loans offer several benefits that make them a convenient and viable option. Here are some of the key advantages:

Accessibility: Online lenders are accessible 24/7, allowing borrowers to apply for a loan at their convenience. Whether it’s early morning or late at night, borrowers can access the application form and submit it online.

They can do so without the need to visit a physical location.

Quick Approval Process: Short-term loans online have a speedy approval process. Online lenders understand that borrowers may require quick access to funds. Especially when facing an emergency or time-sensitive bill payment.

The allows for quick approval and disbursement of funds. It also helps ensure borrowers can receive the help they need promptly.

No Credit Check Required: One of the significant advantages of short-term loans online is that they do not require a credit check. This means that individuals with bad or low credit scores can still be eligible for a loan.

Instead of focusing on credit history, online lenders consider other factors. Factors such as:

- Income stability

- Employment status

This opens up opportunities for individuals facing financial difficulties. To receive the necessary help without being hindered by a poor credit rating.

Flexible Repayment Options: Online lenders understand that each borrower’s financial situation is unique. They often offer flexible repayment options tailored to the borrower’s specific circumstances. This flexibility allows borrowers to choose a repayment plan that suits their budget.

And it ensures they can comfortably make the required payments without straining their finances. These options may include:

- Weekly

- Bi-weekly

- Monthly installment plans

This allows borrowers to choose the frequency and duration of their repayment schedule.

Convenient and Secure Process: Applying for a short-term loan online is a convenient and secure process. With a computer or a smartphone and an internet connection, borrowers can complete the application form from their homes.

Online lenders use advanced encryption technology to protect borrowers’ personal and financial information. This ensures their data remains confidential and secure throughout the application process.

It’s important to note that short-term loans online offer many benefits. However, borrowers should be cautious and responsible when taking on debt. These loans should only be used for temporary financial emergencies and not as a long-term solution. Borrowers should carefully review the terms and conditions of the loan.

They should ensure that they can meet the repayment obligations before accepting the offer.

Responsible Borrowing and Avoiding Debt Traps

While short-term loans online provide needed financial relief, practicing responsible borrowing is crucial. Here are some tips to help you make the most out of your short-term loan and stay on top of your financial obligations:

Borrow Only What You Need: Before applying for a loan, carefully assess your financial situation. From there determine the exact amount you need to cover your bills or unexpected expenses.

Resist the temptation to borrow more than necessary, as it can lead to unnecessary debt and financial strain in the future.

Create a Repayment Plan: Before accepting a loan, create a realistic repayment plan that aligns with your budget. Evaluate your income and expenses.

This is to ensure you can comfortably make the required payments. Doing so without compromising your ability to meet other essential financial obligations.

Stick to the repayment plan. You should avoid defaulting or making late payments, as it can negatively impact your credit score and incur penalty charges.

Research and Compare Lenders: Take the time to research and compare different online lenders. This is to find the most reputable and affordable option for your needs.

Look for lenders with:

- Transparent terms and conditions

- Reasonable interest rates

- Positive customer reviews

Reading feedback from other borrowers can provide valuable insights into their experiences with the lender. It can help you make an informed decision.

Seek Financial Counseling: Do you find yourself consistently struggling to pay bills or manage your finances? It may be beneficial to seek the help of a financial counselor.

These professionals can provide guidance on budgeting, debt management, and long-term financial planning. They can help you develop healthy financial habits. It can also provide strategies to improve your overall financial well-being.

How to Get Help Paying Bills 101

If you’re facing financial difficulties and need help paying bills, short-term loans online can provide the necessary financial relief. Regardless of your credit score, these loans offer quick access to cash and a streamlined application process. By understanding how to apply for a personal loan online and borrowing responsibly, you can overcome temporary financial challenges.

Remember, short-term loans online should only be used for short-term needs and not as a long-term solution. Evaluate your financial situation. Then consider the loan terms and conditions, and ensure you can comfortably repay the loan before accepting it.

Apply for a loan with I Need Help Paying Bills Now.